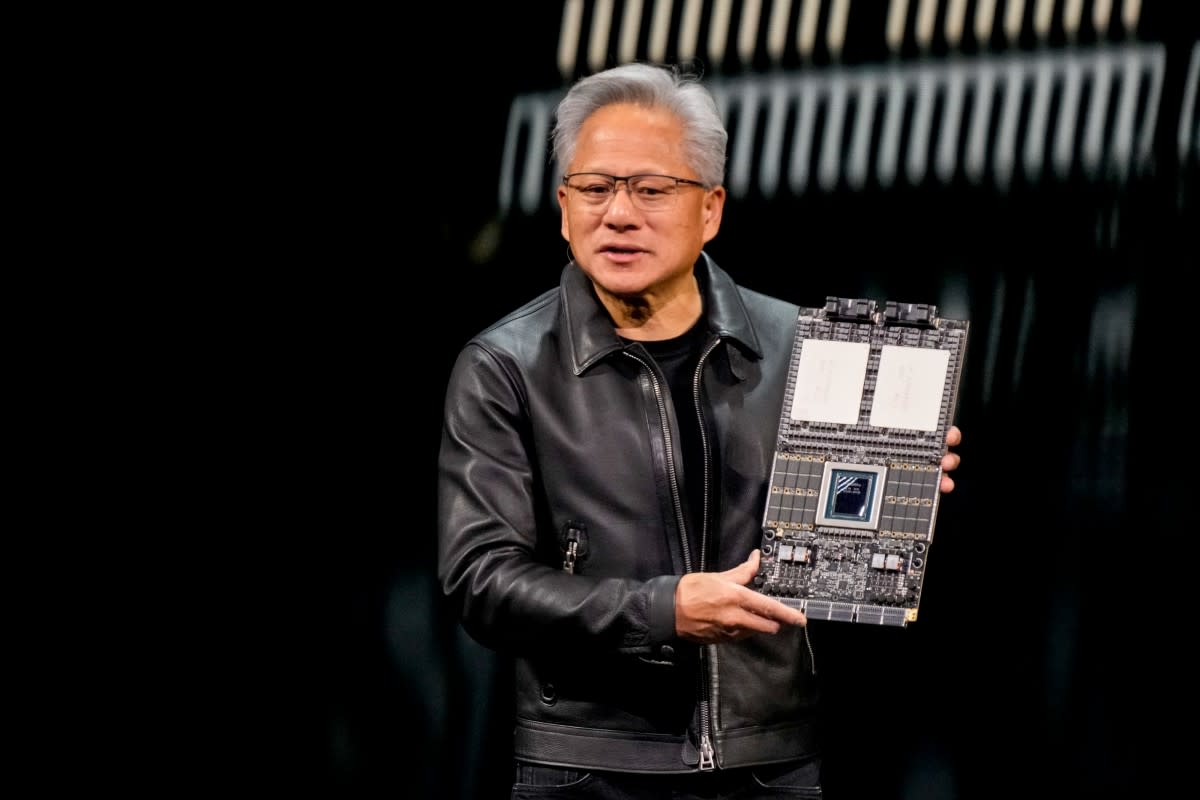

Nvidia’s CEO Jensen Huang says he doesn’t believe the world is entering an AI bubble—he sees it as a major tipping point. According to him, the type of computing Nvidia builds will soon power nearly everything, from software development to massive fleets of real-world robots.

But a growing group of market skeptics sees the situation differently, warning that a tipping point can just as easily lead downward. Nvidia posted earnings and guidance on Wednesday that beat expectations, calming short-term fears. Still, long-term concerns persist that Nvidia’s rapid growth could be slowed by factors beyond the control of even the most valuable publicly traded company in history, now valued at over $4.5 trillion.

In a regulatory filing, Nvidia revealed that most of its explosive revenue comes from just four unnamed customers. In the third quarter, 61% of its $57 billion in revenue came from those clients, up from 56% the prior quarter. Previous disclosures suggest the group may include Microsoft, Meta, and Oracle.

The company also doubled its spending on renting back its own chips from cloud providers—rising to $26 billion from $12.6 billion in Q2—with contracts extending through at least 2031. Nvidia recently said it would invest up to $100 billion in OpenAI and $10 billion in Anthropic, both of which also happen to be major customers.

This high concentration of revenue and the circular nature of Nvidia’s financial ties have raised alarms, especially since most of the companies spending heavily on AI have yet to turn meaningful profits.

“Much of this growth is coming from loss-making startups or unprofitable AI projects,” said Chaim Siegel of Elazar Advisors. “The cycle could easily end badly unless all these companies collectively slow their spending—a scenario that’s nearly impossible.”

Huang Dismisses Bubble Concerns

On the earnings call, Huang insisted Nvidia sees something “very different” from bubble dynamics. He outlined three major transitions that he believes will fuel Nvidia’s growth for years:

-

Non-AI software—such as engineering simulations and data science—shifting from traditional CPUs to Nvidia’s advanced GPUs.

-

Entirely new software categories, including coding assistants and generative tools.

-

AI expanding into the physical world, powering robots, self-driving vehicles, and more.

“These three dynamics will each drive infrastructure growth for years,” Huang said. “Nvidia is chosen because our unified architecture supports all three.”

However, turning this vision into reality requires massive amounts of land and energy—concerns shared even by Nvidia supporters like Ivana Delevska of Spear Invest.

Huang responded by saying Nvidia is already building partnerships across land development, power infrastructure, data center operators, and financing groups.

“None of these challenges are easy,” he said, “but all are solvable.”

Competition and Risks Ahead

Even as Nvidia works to secure its future, rivals are making moves. Companies like Alphabet and Amazon are developing their own AI chips and selling them to the same types of customers Nvidia relies on. That raises questions about whether Nvidia can maintain its dominance.

“They’ve said they’re sold out for this year and likely next year,” said Jay Goldberg of Seaport Research Partners, who maintains a sell rating on Nvidia. “So I’m not sure what upside surprises are even possible. The list of risks is now longer than the list of things that could go right.”